Blockchain in FinTech: How It Can Remodel the Industry

Advances in IT and favorable conditions in global economies and legislation systems have given impetus to the development of the financial sector, taking FinTech companies to one of the top places in the digital world economy. We have discussed AI benefits for FinTech startups and the best ways to use it in the financial ecosystem. Today, the software development team of Powercode wants to focus your attention on the topical subject of how blockchain, one of the most crucial modern technologies, modifies the FinTech industry. Let’s start with statistical data that, as it is known, do not lie.

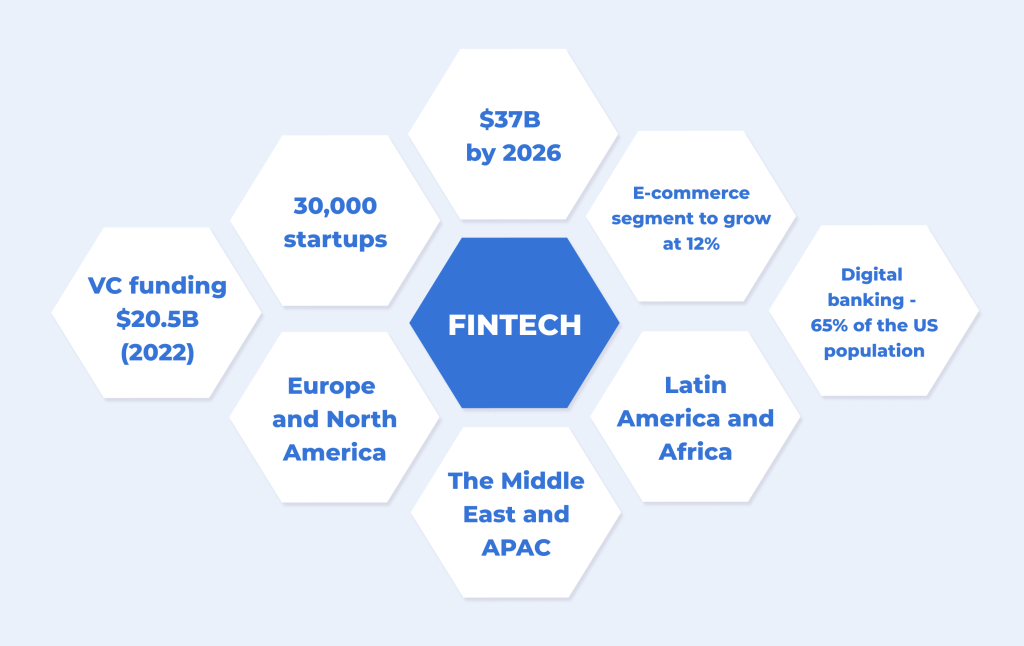

FinTech in Figures

- FinTech is one of the most invested industries in the world.

- There are about 30,000 fintech startups (data for the end of 2022).

- The fintech market will be worth more than $37B by 2026.

- Approximately 65% of the US population used digital banking in 2022.

- The global VC funding of Fintech was $20.5B in 2022.

- The global fintech market is predicted to increase at a CAGR of almost 17% between 2023 and 2028.

- Europe, North America, the Middle East, APAC, Latin America, and Africa are the principal markets for fintech.

- The fastest-growing FinTech market is Asia Pacific, and the largest market is North America.

- By 2024, continental China and the United States will account for more than 60% of the total value of fintech transactions worldwide.

- The FinTech market’s e-commerce segment is expected to grow at a 12% annual growth rate up to 2026.

- In Q2 2022, revenue-based financing has grown by 28% compared to the 2021 average data and reached $469M.

- In H1 2022, MENA FinTech funding increased the most.

- London has attracted more fintech funding than any other global location in 2022.

- According to research, implementing chatbots will enable banks to save about $7.3B by 2023.

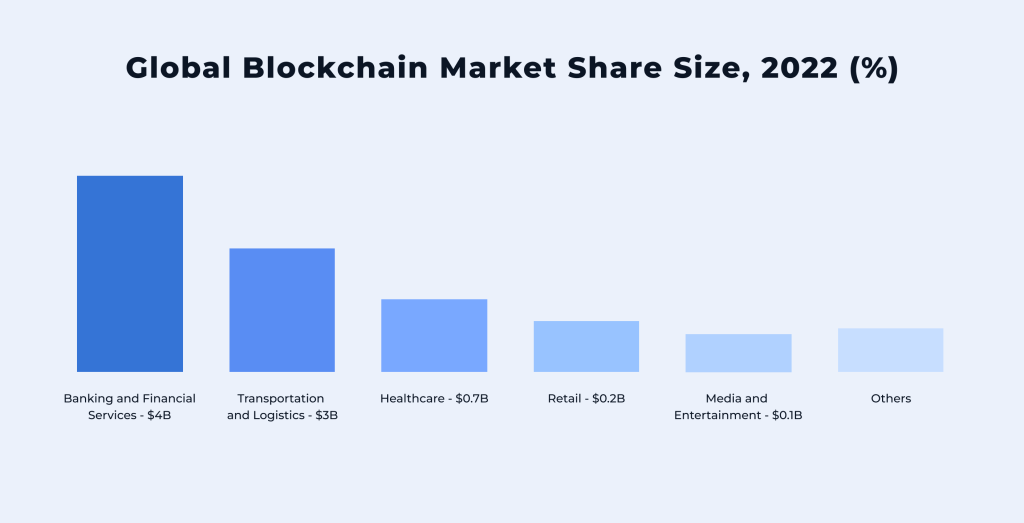

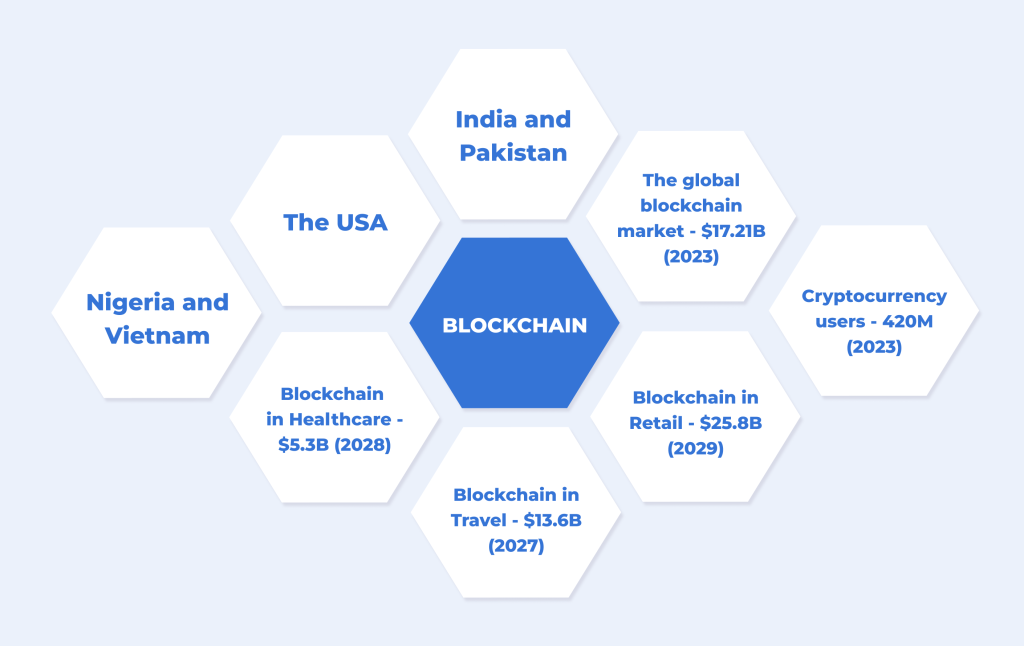

Blockchain in Figures

- The global blockchain market size will grow from $10.13B in 2022 to $17.21B in 2023 at a compound annual growth rate of 70%.

- The banking and financial services market is expected to reach $12.39 billion in 2026 at a CAGR of 60%.

- Nonfungible Tokens (NFT) began to be considered as “private property” in 2022, according to the London High Court of Justice.

- The average percentage of people who possess cryptocurrencies worldwide is expected to be 4.2%, with more than 420 million users in 2023.

- Top Crypto Countries are the USA (46 million), India (27 million), Pakistan (26 million), Nigeria (22 million), and Vietnam (20 million).

- According to the report of Hootsuite, the highest percentage of cryptocurrency owners worldwide is among men aged 24-35, and equals 15.5%. The lowest rate is among females aged 55-64 – 3.5%.

- Today, more than one in ten working-age internet users hold some “crypto.”

- On Chainalysis’s 2022 Global Crypto Index, Ukraine is third, moving up one position from 2021.

- By 2028, the market for Blockchain in healthcare is projected to be worth $5.3B, increasing at a market growth of 39.9% CAGR.

- In 2022, the European region dominated the market for Blockchain in healthcare, with a share of about 36%.

- By 2029, the market for blockchain in retail is anticipated to reach $25.8B, growing at a CAGR of 68.3% between 2022 and 2029.

- The blockchain technology market in the transportation and logistics industry is expected to grow gradually by $2,230.89M between 2023 and 2027, at a CAGR of 39.78%.

- The global market for travel technologies is expected to reach $13.6B in value by 2027, growing at a 6.8% CAGR.

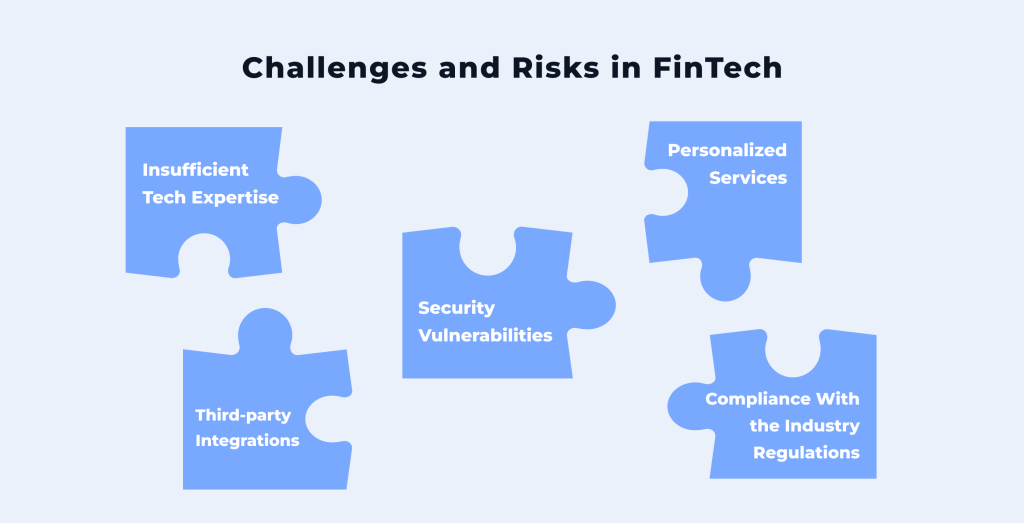

The Most Common Challenges and Risks in FinTech

Security Vulnerabilities. A significant increase in FinTech companies and their deep penetration into the online space has made the matter of security one of the most topical. Vast amounts of sensitive consumer data, the leak of which can lead to disastrous consequences, are transmitted every day. Legal entities and individuals transfer funds online, and financial establishments have to guarantee their secure movements between accounts. Many fintech apps can also be subjected to DDoS attacks due to the lack of appropriate protective resources. As for consumers of Fintech services, they can suffer from modern phishing attacks when hackers pose as official representatives of various financial institutions and lure out secret financial information.

Compliance With the Industry Regulations. Those who have already worked in the fintech sector note the absence of strict unified rules and regulations. Until 2021, many countries did not have laws at the state level dealing with fintech issues. Now the situation is changing, and each country is trying to adopt its own regulations that define the standards of cooperation, which improves the condition in the domestic market but only applies a little to the external one. Thus, the USA has three important institutions that supervise all financial operations and services – The Securities Exchange Commission, The Office of the Comptroller of the Currency, The Consumer Financial Protection Bureau, and The Financial Crimes Enforcement Network. In Europe, the principal regulatory body for fintech businesses is the European Securities and Markets Authority.

Insufficient Tech Expertise. Based on data revealed by The Global Findex Database, receiving wages, government subsidies, and other payments digitally has led to increased use of related financial services. Such a situation has led to a drastic increase in the account number, which reached 76% of the global population and 71% of citizens in developing countries. Thus, businesses need more advanced financial applications to provide and manage digital operations. However, the number of experienced programmers who are kept up-to-date with the latest technological developments in the area of cybersecurity, software-as-a-service or platform-as-a-service cloud computing, and FinTech approaches is not unlimited, which can result in particular challenges and time-consuming while finding the appropriate team and developing the product. Due to their expertise and ability to provide real-life cases, more financial businesses prefer to hire outsourced FinTech app developers to build well-crafted applications for their clients. It would help if you comprehended the principles of building a high-performance team for your projects, which we outlined in one of our articles.

Third-party Integrations. The range of mobile and desktop financial apps is vast – from simple personal finance applications and financial data analysis to investment platforms. The functionality they offer is also extensive, the implementation of which often requires third-party integrations, which, in the case of the financial and banking technologies industry, can lead to a security breach not only of the product itself but also of the company’s data.

Personalized Services. According to a recent study, businesses that effectively manage personalization features have a 40% higher probability of increasing income. It is explained by the fact that up to 76% of consumers are willing to cooperate and buy products and services from companies that demonstrate customer care through personalized interactions. Banking and finance are no exceptions. However, modern digital personalization requires interaction with the client in real-time or at their convenience through their preferred communication channels. As we discussed earlier, implementing AI makes this process much easier and more efficient. A well-designed personalization system interacts effectively with consumers, providing them with exceptionally required options.

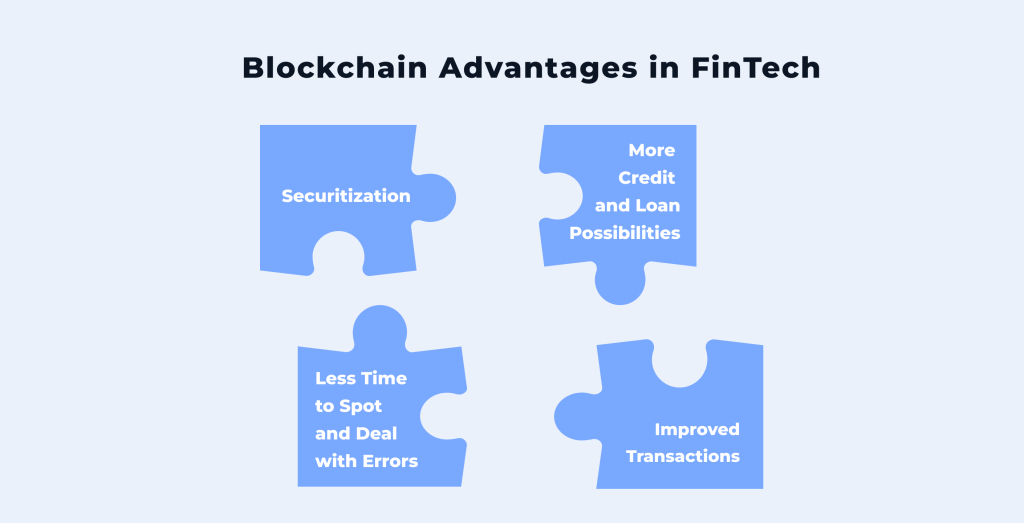

Advantages of Blockchain in FinTech

Securitization. Due to its cryptographical features and decentralized nature, when data is kept in chain-like connected blocks, blockchain technology dramatically reduces security issues. Hackers cannot process and manipulate information easily as it is not held on one server and is distributed among various computers. Any participant with the required permissions can access transaction data whenever they want. Moreover, blockchain records are unchangeable without the possibility of destroying or deleting them. As for privacy issues, blockchain employs permissions to restrict access and encrypts or anonymizes the user’s information.

Improved Transactions. To make a regular bank payment, you must go through several stages and bypass several correspondent banks. It can be time-consuming since each such establishment holds a different ledger at the sending and receiving banks. Blockchain principles enable it to act as a decentralized transaction register and monitor all transactions in an open and transparent way, eliminating the need for custodian services and other mediators. These middlemen-free activities reduce payment processing costs for international payments significantly. Also, all operations can be done on a public blockchain, and it is possible to clear and settle a transaction immediately after the payment.

More Credit and Loan Possibilities. Blockchain is upgrading the lending market by enabling peer-to-peer (P2P) lending and sophisticated programmed loans. Previously, you had to visit the bank and fill out an application, which the bank then carefully reviewed for several days while evaluating your credit history and loan repayment capacity. They spent more time doing this by also asking for information from third-party services. DeFi features and functionality now enable clients to select which money market they want to lend to and earn interest from, depending on the market’s yield. Besides, blockchain-enabled lending broadens a customer base, saves costs, and improves efficiency and security throughout the loan process. Applicants may request and get approved for a cryptocurrency credit within a few clicks or moments, saving them precious time, nerves, and, of course, money.

Less Time to Spot and Deal with Errors. Blockchain enables financial institutions to monitor and manage transactions quickly and better. It becomes possible to detect any shortcomings or oversight on time, preventing the situation from aggravating and causing detrimental consequences for the parties involved.

Four Top Most-Funded FinTech Startups in 2022

Bloom. Since 2019, the Luxembourg-based fintech startup Bloom has been funding eCommerce companies with the capital they require. Their pricing scheme and unique features, such as pay-as-you-go, set them apart from competitors. Despite a short market operation period, the startup managed to attract a large Series A investment of $377M in 2022.

Nowports. Founded in 2018, Nowports, a Mexico-based digital freight forwarder, has become one of the most trusted platforms among significant investment funds and entered the list of the few unicorns based in Latin America. Over six rounds, they successfully obtained more than $240M in funding. The most recent money came from the Softbank Latin America Fund in May 2022 (Series C round).

Mondu. Mondu is a B2B payment fintech startup founded in 2021 and headquartered in Berlin, Germany that provides B2B merchants and marketplaces with a flexible payment method with net terms (Buy Now, Pay Later). It has secured funds totaling $89.4M throughout five rounds, with the latest Series A round of 13M in January 2023.

Bud. Bud is an Open Banking platform that was created in 2015 in London. Its primary objective is to allow users to combine all consolidated datasets with their personal information to complete a unified customer view. Bud’s platform covers more than 96% of UK current accounts. The total funding amount equals $102M over four rounds, with the most recent funding, an $80 million Series B round, obtained on June 7, 2022.

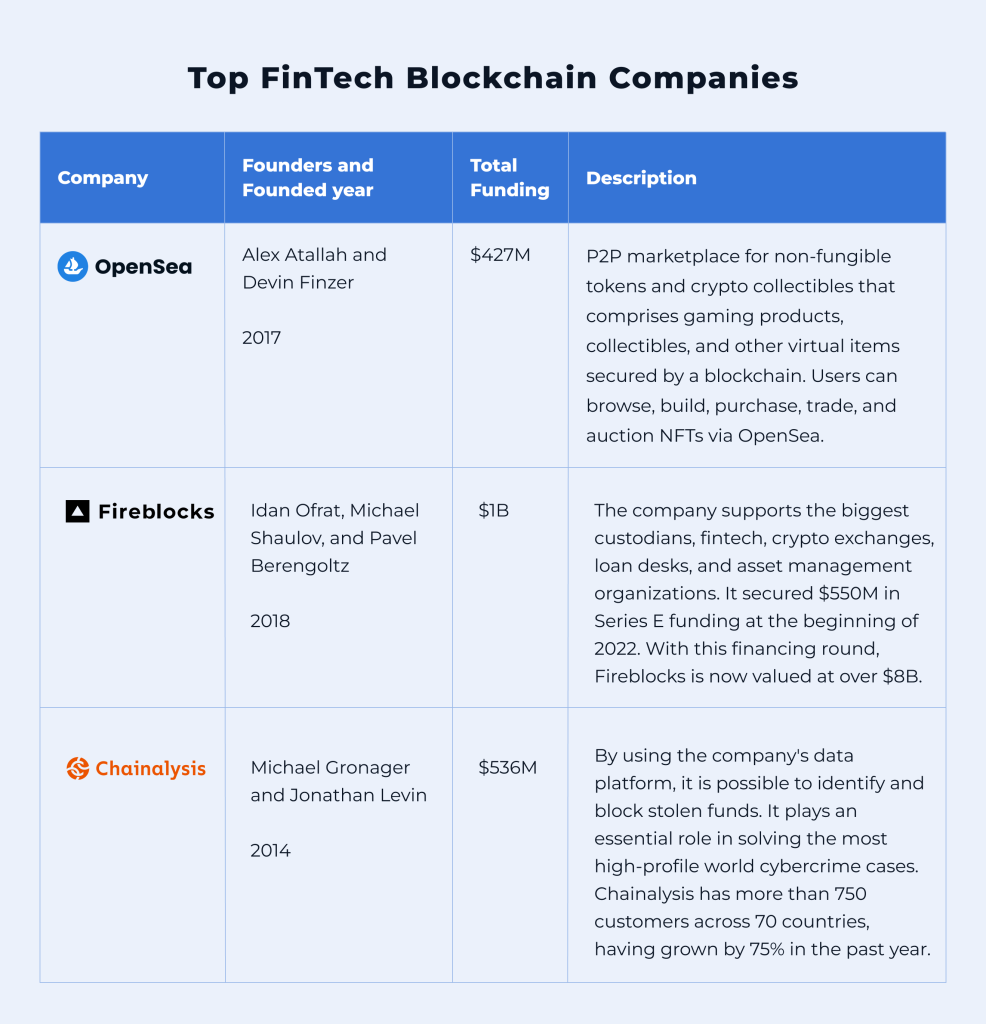

Top FinTech Blockchain Companies To Know About in 2023

How can VSHolding Help?

Integrating blockchain into the financial industry is a complex but effective process that can improve the functioning of a business. A cryptographic security system, a distributed ledger, the ability to manage your own data and resources at any time from any place in the world, etc., make the technology attractive to an increasing number of financial institutions. Powercode specialists deliver tech solutions for more thoughtful and elaborate finance management and quick and secure money flow maintenance. Improved operations help our customers enhance user experience, promote fruitful cooperation, and become more competitive in the market. We are qualified to create the required high-quality software solution that satisfies all your requirements and has all the special features you demand. All you need to do is reach our developers and professionals in other fields who are ready to discuss your project’s details and start working.